PART B: State Of The Economy - Macroeconomic Review

SUMMARY OF GLOBAL AND DOMESTIC ECONOMIC AND FINANCIAL DEVELOPMENTS

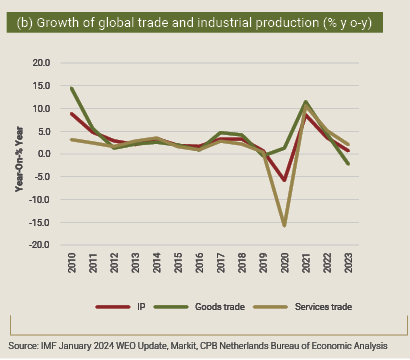

The global GDP growth rate is estimated to have decelerated in 2023 from the rate recorded in 2022. The global GDP growth rate declined from 3.5 percent in 2022 to 3.1 percent in 2023. This can be attributed to high interest rates, the enduring effects of the COVID-19 pandemic, and the gradual reduction of fiscal assistance. Economic growth in most advanced economies (AEs) and several emerging market and developing economies (EMDEs) decelerated in 2023, except in the United States, where predictions are that growth remained stable. On the other hand, China, Japan, and Russia experienced an upturn in growth during the same period.

Real global GDP is expected to increase at the same rate in 2024 as in the previous year, but there are downside risks to consider. The International Monetary Fund (IMF) expects the real GDP growth rate in AEs to moderate to 1.5 percent in 2024, down from 1.6 percent in 2022. In EMDEs, it is projected that real GDP will maintain the same pace of growth in 2024 as in 2022, namely 4.1 percent. On a positive note, countries in sub-Saharan Africa are expected to recover in 2024. Overall, global growth is anticipated to be at 3.1 percent in 2024, the same rate as estimated for 2023. However, there are downside risks to the outlook due to the lagged and ongoing effects of tight monetary policy, as well as risks from escalating conflicts in the Middle East. Additionally, the slowing Chinese economy and climate-related disasters are likely to restrict global economic activity and growth in 2024.

Global inflation declined in 2023, as supply chains eased and transportation costs declined, with the result that policy interest rates remained unchanged in the latter part of the year. Inflation declined in AEs and EMDEs, mainly due to a reduction in energy and transportation costs, coupled with a fall in the costs for food due to an abundant supply of agricultural products attributed to favourable weather. Global inflation is projected to decline further to 5.8 percent in 2024, from 6.9 percent in 2023, as tight monetary policy continues to take effect.

Financial markets witnessed significant events in 2023. In March 2023, the collapse of Silicon Valley Bank and a major bond sell-off resulting from higher interest rates were among the notable market dynamics. However, by late October 2023, several asset classes began to rebound as declining inflation and anticipated rate cuts instilled confidence. The year ended on a positive note for both stock and bond markets, with an increased appetite for both riskier assets and sovereign bonds. Conversely, the prices of most monitored commodities declined throughout the year. In contrast, the demand prospects for uranium and gold surged due to countries’ pursuit of energy security and reduced fossil fuel emissions, as well as the safe-haven1 demand driven by the Israel-Hamas war, respectively. In the currency market, the US Dollar (USD) appreciated against a basket of currencies, while the South African Rand (ZAR) exchange rate depreciated against major currencies.

GLOBAL ECONOMIC AND FINANCIAL DEVELOPMENTS

Real Global GDP growth for 2023 is estimated to have slowed compared to 2022, primarily due to high interest rates, a weaker Chinese economy, and tight financial conditions. Despite the unfavourable economic environment in 2023, the US economy demonstrated resilience by registering a growth rate of 2.5 percent, compared to 1.9 percent in 2022 (Figure B.1a). Similarly, Japanese GDP growth rose to 1.9 percent in 2023, faster than the 1.0 percent recorded in 2022. In contrast, the Eurozone experienced slower GDP growth of 0.5 percent in 2023, compared to 3.4 percent in 2022. Additionally, the United Kingdom (UK) registered a deceleration in GDP growth, which stood at 0.5 percent in 2023, compared to 4.3 percent in 2022.

|

|

Among the emerging market and developing economies (EMDEs), there was encouraging performance with robust growth observed in the overall region. The group of EMDEs is estimated to have recorded a growth rate of 4.1 percent in 2023, the same as in 2022 (Figure B.1a). This robust growth was mainly driven by India, which maintained the highest growth rate of 6.7 percent in 2023. Furthermore, Russia’s GDP growth recovered to 3.0 percent in 2023, following a contraction of 1.2 percent in 2022. Additionally, China’s GDP increased at a faster rate of 5.2 percent in 2023, compared to 3.0 percent in the previous year. Brazil’s real GDP growth rate was 3.1 percent in 2023, up from 3.0 percent in 2022. Conversely, South Africa’s GDP growth slowed to 0.6 percent from 1.9 percent in 2022.

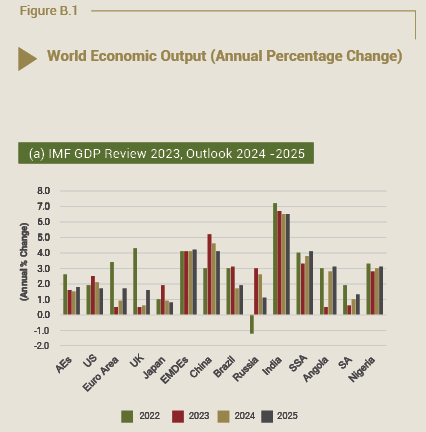

Global trade declined in 2023, primarily due to weaker demand from developed countries and a decrease in commodity prices, while global industrial production increased at a slower pace. Global trade in goods contracted by 2.2 percent in 2023, marking the first annual decline outside of global recessions in the past 20 years (Figure B.1b). This decline can be attributed to geopolitical strains, shifting trade patterns, and high borrowing costs. On the other hand, global trade in services recorded growth of 2.1 percent, slower than the 5.1 percent growth observed in 2022. This growth was supported by the ongoing normalisation of travel in Asia, which boosted tourism. The World Bank projects that global trade will recover by 3.3 percent in 2024, although it is expected to be negatively impacted by rising trade distortions and geoeconomic fragmentation.

INFLATION AND INTEREST RATE DEVELOPMENTS

Inflation declined in most of the monitored AEs in 2023 compared to 2022, as supply chain pressure eased and transportation costs declined, except in Japan, where they rose. The inflation rate in the US slowed to an average of 4.1 percent in 2023, down from 8.0 percent in 2022, on the back of declining energy costs (Table B.1). Similarly, inflation in the UK declined to 7.4 percent in 2023, down from 9.1 percent in the previous year, due in part to the reduction in energy prices following the Office of Gas and Electricity Markets’ decision to lower the cap on household bills, in addition to easing food inflation. In the Eurozone, inflation declined to 5.5 percent in 2023 from 8.4 percent in 2022, led by the lower costs of energy and food. Conversely, inflation in Japan rose slightly to 3.3 percent from 2.4 percent in 2022, partly driven by the depreciation of the Japanese Yen against major currencies.

Inflation in the EMDEs also decelerated in 2023, compared to high levels experienced in 2022. Inflation in Brazil decreased to 4.6 percent in 2023 from 9.4 percent in 2022. This decline can be attributed to lower prices of transportation, food, and non-alcoholic beverages (Table B.1). Similarly, India saw a decrease in inflation from 6.7 percent in 2023 to 5.6 percent in the previous year. Furthermore, Russia experienced a significant drop in headline inflation from 13.8 percent in 2022 to 6.0 percent in 2023. This decline was mainly due to falling costs of food, gasoline, medicines, and tobacco. The Chinese economy’s consumer prices also declined notably from 2.0 percent in 2022 to 0.2 percent in 2023. This decrease was primarily driven by an abundant supply of agricultural products as a result of favourable weather conditions. Additionally, a fall in consumption after the Golden Week holiday towards the end of 2023 and weak recovery in domestic demand contributed to the decline. In South Africa, the annual inflation rate decreased from 6.9 percent in 2022 to 5.9 percent. This decrease was mainly attributed to the lower cost of transportation and a decrease in the cost of food, supported by ample supplies following favourable harvests during the review period.

Many of the monitored AEs raised their policy rates in 2023, except for Japan, which kept its call rate unchanged. In 2023, the US Federal Open Market Committee increased its federal funds rate target range by 100 basis points to 5.25–5.50 percent (Table B.2) to address the elevated inflation. Similarly, in 2023, the Bank of England raised its key interest rates by 175 basis points to 5.25 percent to combat high inflation. Additionally, the European Central Bank increased its policy interest rate by 200 basis points to 4.50 percent in 2023 to control upward price pressures. However, the Bank of Japan maintained its call rate at -0.10 percent and 10-year bond yields at around 0.0 percent in 2023.

The majority of the monitored central banks in the EMDEs raised their benchmark interest rates in 2023 in response to rising inflation, except for Brazil and China, where interest rates were reduced. In 2023, the Reserve Bank of India increased the benchmark policy repo rate by 25 basis points to 6.50 percent to address elevated inflation and align it with its tolerance range of 4 percent ± 2 percent. The South African Reserve Bank (SARB) reduced the repo rate by 125 basis points to 8.25 percent in 2023 to combat high inflation and enhance confidence in achieving the inflation goal (Table B.2). The Central Bank of Russia raised its key interest rate by 850 basis points to 16.00 percent in 2023 to combat elevated inflation and expected inflationary pressures. In contrast, the People’s Bank of China reduced policy rates by 20 basis points to 3.45 percent to support a slowing and weakening economy. Furthermore, the Central Bank of Brazil reduced its Selic rate by 200 basis points to 11.75 percent in 2023, in line with declining inflation and to support weak economic activity.

COMMODITY MARKET DEVELOPMENTS

The price of uranium rose in 2023, while that of Brent crude oil declined, compared to the respective 2022 prices. The price of uranium increased by 25.5 percent, reaching an average of US$62.51 per pound in 2023 (Figure B.2). This increase was largely attributed to strong demand for energy security, as well as China’s growing need for uranium in its nuclear projects. Additionally, the decision made by uranium producer Cameco to reduce its production has continued to support the price of uranium. Conversely, the price of Brent crude oil declined by 16.8 percent, averaging US$80.76 per barrel in 2023. This decline was mainly attributed to a deteriorating global economic environment. As a result, gasoline deliveries hit their lowest point in two decades. The fragile state of industrial production, particularly in China, also exerted downward pressure on oil prices. Interestingly, despite the production cut imposed by the Organization of Petroleum Exporting Countries, oil prices still experienced a decline.

The prices of copper and zinc declined, while that of gold increased in 2023 over 2022. The average price of copper dropped by 3.8 percent to U$8 490 per metric tonne in 2023 (Figure B.2). This was on the back of declining demand, especially from China. Meanwhile, zinc prices dropped by 23.8 percent to an average of US$2 653 per metric tonne in 2023, chiefly attributed to weak demand, notably from China. On the positive side, the gold price increased by 7.9 percent to an average of US$1 943 per ounce in 2023, mainly on the back of safe-haven demand driven by the Israel-Hamas war.

In 2023, diamond prices continued to decline. According to the International Diamond Exchange diamond price index, there was an 18.2 percent decrease, with the index averaging approximately 97.42 points (Figure B.4). The weakening consumer demand for polished diamonds in the US and China contributed to the downturn in the diamond market. The US, which represents the largest market in the industry, faced challenges due to increasing inflationary pressure. Additionally, China, a key growth market, experienced a real estate crisis that negatively impacted consumer confidence. Furthermore, the diamond market also faced an oversupply issue because of people stockpiling goods during the pandemic and choosing to purchase diamond jewellery and other luxury items while staying at home. To exacerbate the situation, the lab-grown diamond industry made significant advancements in certain crucial sectors, thus constituting formidable competition to the natural diamond sector.

STOCK MARKET DEVELOPMENTS

Global stock market indices ended 2022 with losses, on concerns of rising interest rates, the appreciating US dollar exchange rate and the prospects of a global slowdown. This was observed across most of the developed equity markets, with the US’s S&P 100 experiencing the biggest decline of 19.0 percent (Figure B.3). This was mainly due to skyrocketing global inflation as well as investors feeling disheartened regarding the market, as recession fears continue. The highly transmissible Omicron subvariant, XBB.1.5, also contributed to this performance. Germany’s DAX index slipped by 11.9 percent in 2022 as German companies came under significant inflation pressure. Stock markets in China and Russia recorded losses of 17.7 percent and 43.1 percent, respectively. South Africa’s JSE ALSI was somewhat resilient, as it only lost around 1.0 percent in 2022, while the UK’s FTSE100 generated a 1.0 percent gain.

THE DOMESTIC ECONOMY AND FINANCIAL DEVELOPMENTS

STOCK MARKET DEVELOPMENTS

The stock markets had a successful year in 2023, despite concerns among investors of a recession. They faced some uncertainty in the first half of the year due to declining corporate earnings. Worries about a banking crisis resulting from the collapses of Silicon Valley Bank, Signature Bank, and First Republic Bank also contributed to market volatility in equities. However, towards the end of the year, equities began to recover, thanks to strong job growth, decreasing inflation, diminishing recession fears, and improved corporate earnings. The S&P 500 defied concerns about the sustainability of the fiscal outlook and the US debt downgrade, recording yearly gains of 17.3 percent to end the year at 4 528 points. Germany’s DAX also gained 13.8 percent, reaching 15 919 points in 2023. The Japanese Nikkei likewise recorded gains of 28.7 percent, ending the year at 33 585 points. Similarly, the UK’s FTSE 100 reported minor gains of 0.5 percent, reaching 7 504 points. On the other hand, the EMDE stock markets lost ground, with China’s FTSE A50 experiencing losses of 10.7 percent. These losses were primarily driven by poor investor sentiment due to slowing economic growth and ongoing issues in the real estate sector. Likewise, South Africa’s JSE ALSI also recorded losses of 2.3 percent, reaching 71 393 points, tracking the performance of the Chinese stock market.

The global GDP growth rate experienced a deceleration in 2023 due to high interest rates, a weakened Chinese economy, and tight financial conditions. Despite the unfavourable economic environment, the US economy demonstrated resilience. In contrast, the Chinese economy continued to falter and exhibited deflationary tendencies as a result of weak demand. Similarly, the Eurozone was weaker in 2023 compared to the previous year. As China is the largest global consumer of commodities, the currently subdued recovery in the Chinese economy could potentially harm both Namibian commodity prices and export revenue. Additionally, South Africa’s economic challenges, notably electricity supply issues, directly affected Namibia’s manufacturing sector and overall economy. However, congestion in South African ports may present opportunities for the expansion of Walvis Bay port as a regional logistics hub. The IMF anticipates a decline in growth for AEs in 2024, while EMDEs are projected to experience a moderate recovery. Overall, global growth is expected to reach 3.1 percent in 2024, the same rate estimated for 2023.

REAL SECTOR DEVELOPMENTS

GDP GROWTH

The Namibian economy built up further momentum during 2023, but at a slower pace than in 2022. The growth of the Namibian economy scaled down to 4.2 percent, compared to marked growth of 5.3 percent recorded in 2022 (Figure B.8), on the back of slower growth in the primary and secondary industries. The slowdown in 2023 growth was largely ascribed to weaker demand in global and domestic economies, underpinned by high inflation and high interest rates that had a negative impact on consumer spending. Other factors contributing to the slowdown in 2023 growth were the high base effects in the mining industry, where diamond mining had expanded by 45.1 percent in 2022.

Contributions to real GDP growth by industry

During 2023, the economic growth largely stemmed from a slowdown in the growth of economic activity in the primary and secondary industries. Primary industry rose at a slower pace, mainly on the back of lacklustre performance in the diamond mining and agriculture sectors. This was primarily due to unfavourable diamond prices, resulting from weaker consumer and retailer demand in key markets, which depressed domestic diamond production. In addition, the erratic and insufficient rainfall received in the 2022/23 rainfall season jeopardised local crop production. Similarly, secondary industry growth was partly weakened by the weaker global demand, in addition to local operational dynamics. While production by the food industry expanded, beverage output and diamond cutting and polishing activity shrank, resulting in an overall contraction in the manufacturing sector. By contrast, electricity production soared bolstered by good rainfall in the catchment area feeding the Ruacana hydroelectric power station. On the other hand, activity in the construction sector declined, during 2023. The decline was mainly evident in Government and private construction work programmes. However, relief arose from tertiary industry, which experienced broad-based growth during the period under review. This growth arose in various sectors, including the wholesale and retail, administrative and support services, hotels and restaurants as well as transport and storage sectors.